Once your Blocked Account is open, you can transfer your blocked amount to it. With Expatrio Payment, you can transfer the funds in your local currency if you wish.

- Blocked Account

Blocked Account for your German Visa

Convenient, trustworthy, fully digital

Money-back guarantee in case of visa rejection.

-

Accepted by German authorities.

-

Blocked Account in your name with German IBAN.

-

Fast, secure, affordable.

How Our Customers Feel About Our Service

Moving to Germany to study, for a new job, a new life?

Open a Blocked Account now to secure your German visa.

Coming to Germany for university studies, language courses, preparatory courses (Studienkolleg), job search, and more?

Get your German visa with ease - from fast processing and affordable set-up fees to secure transactions and high customer service standards. Your Blocked Account allows you to prove sufficient financial resources during your stay in Germany.

Forget about tedious German bureaucracy, language barriers, and hidden fees. We simplify the process and do the hard work for you.

NEW: Get your free German Bank Account automatically connected to your Blocked Account.

Send, receive, and manage your money in one place.

What is a Blocked Account (Sperrkonto) in Germany?

The Blocked Account (Sperrkonto) is a special type of bank account required by German law for many internationals to secure their German visa.

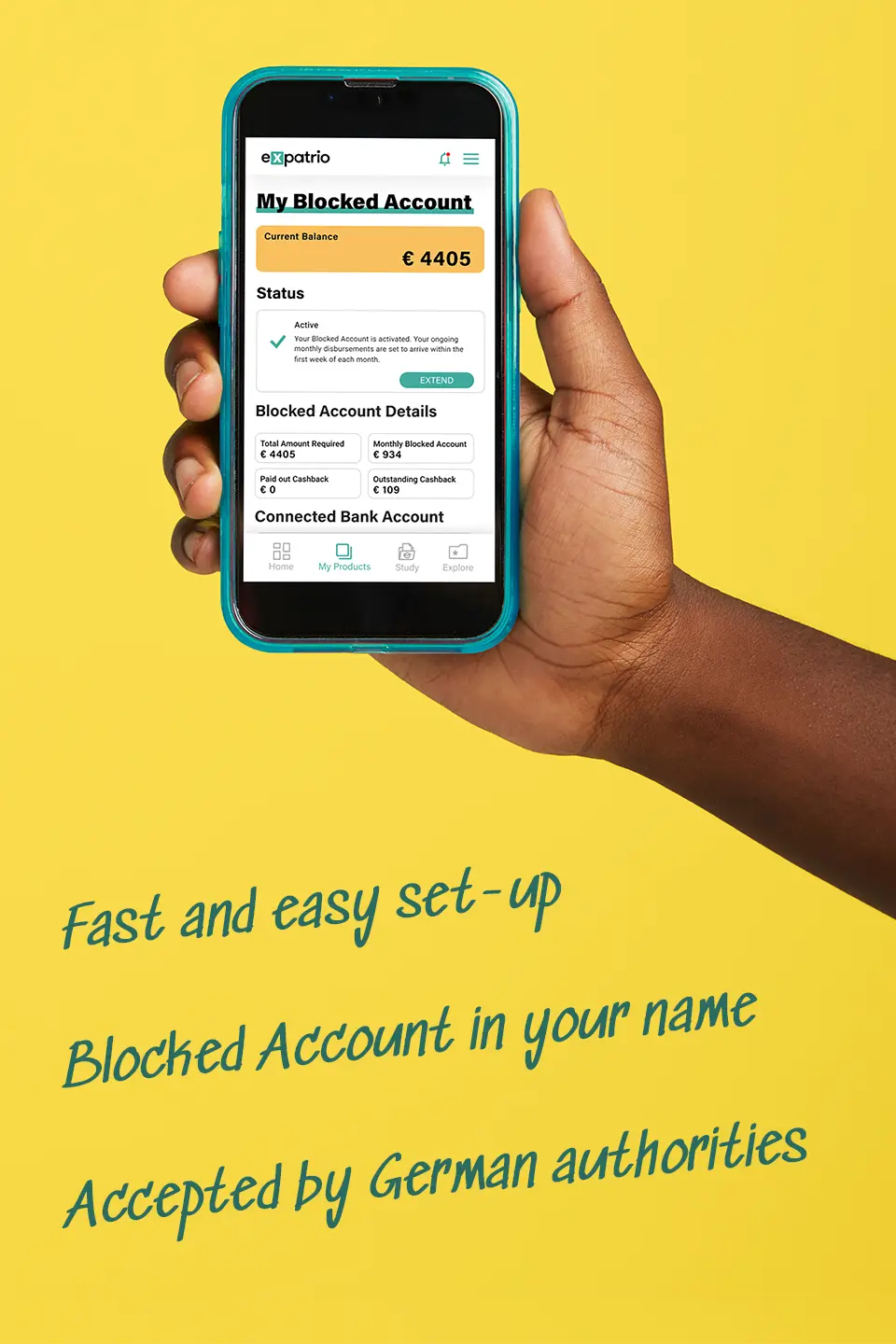

At Expatrio, you can quickly open your Blocked Account entirely online in just a few minutes. Our Blocked Account is accepted by all German authorities worldwide to secure your German visa.

Cost Breakdown

- Monthly fee: Only €5

- Blocked Account set-up fee:€69

Blocked Account

Benefit from a simple and fast service

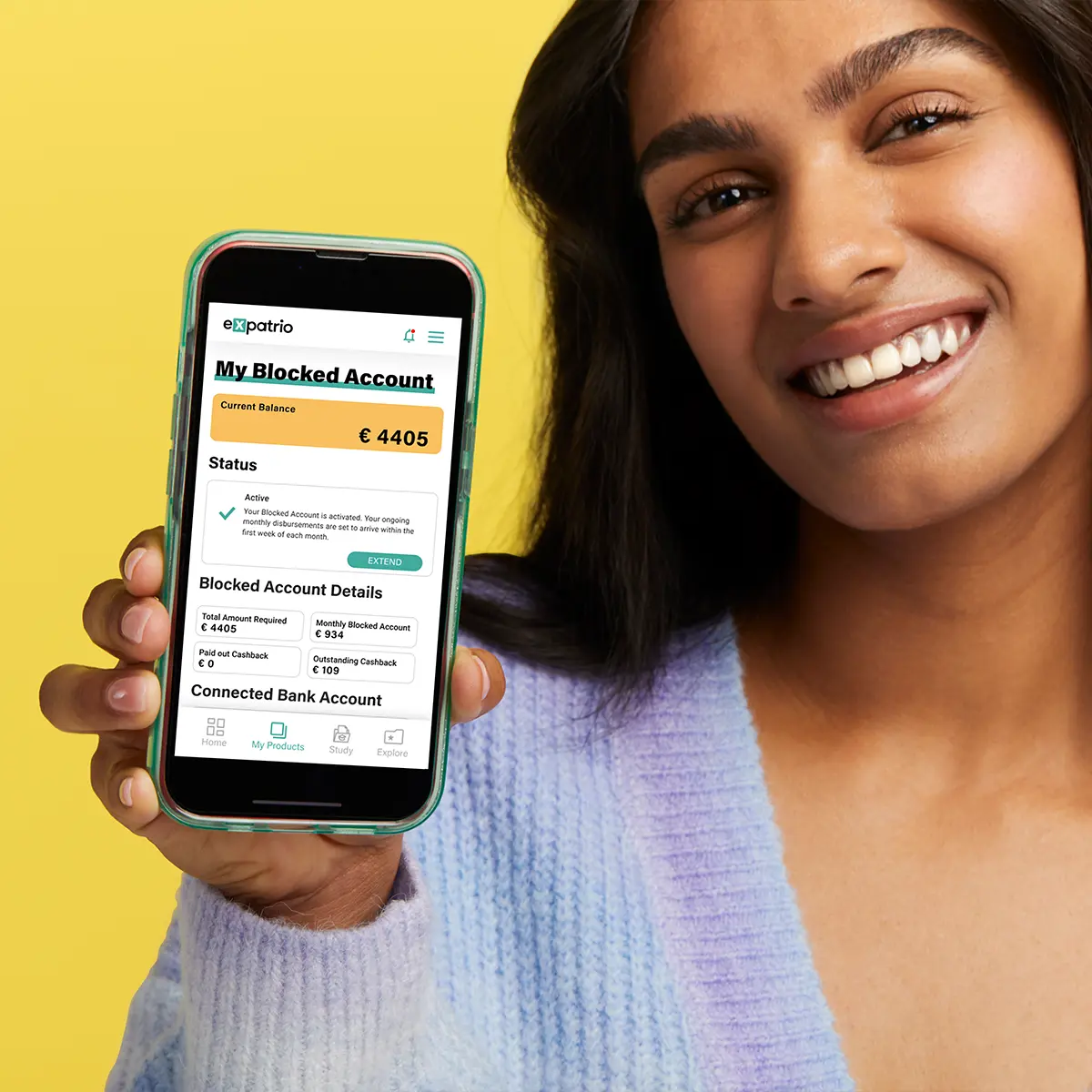

Expatrio’s Blocked Account is one of the fastest ways to secure your proof of sufficient funds for your German visa. Our process is fully online and super simple. On your profile in the Expatrio User Portal, you have easy access to detailed information about your Blocked Account and other Expatrio services.

To open your account, just follow our application flow, and you’ll have your Blocked Account for your time in Germany within a few minutes. Should you have any questions, our Customer Support team is happy to help you throughout your entire journey.

Enjoy low fees

Our low monthly and set-up fees allow you to save money for what really matters during your relocation to Germany.

-

One time set-up fee: €69

-

Monthly fee: €5

Tip!

Get our Expatrio Value Package and get up to €269* worth of free benefits, including €69 cashback on your initial set-up fee, as well as many other perks!

Transfer money in your local currency

To minimize high rates when transferring funds from your home country to your Blocked Account in Germany, you have the option of transferring your money in your local currency. You can do this via our Expatrio Payment process, offered in partnership with the international payment provider, Cohort Go.

With Expatrio Payment, you can pay in your local currency and with the latest payment methods, like Alipay. Paying in your local currency is usually much faster and more affordable than transferring from a local bank to your Blocked Account in Germany. But don't worry, you can also use the traditional bank transfer option.

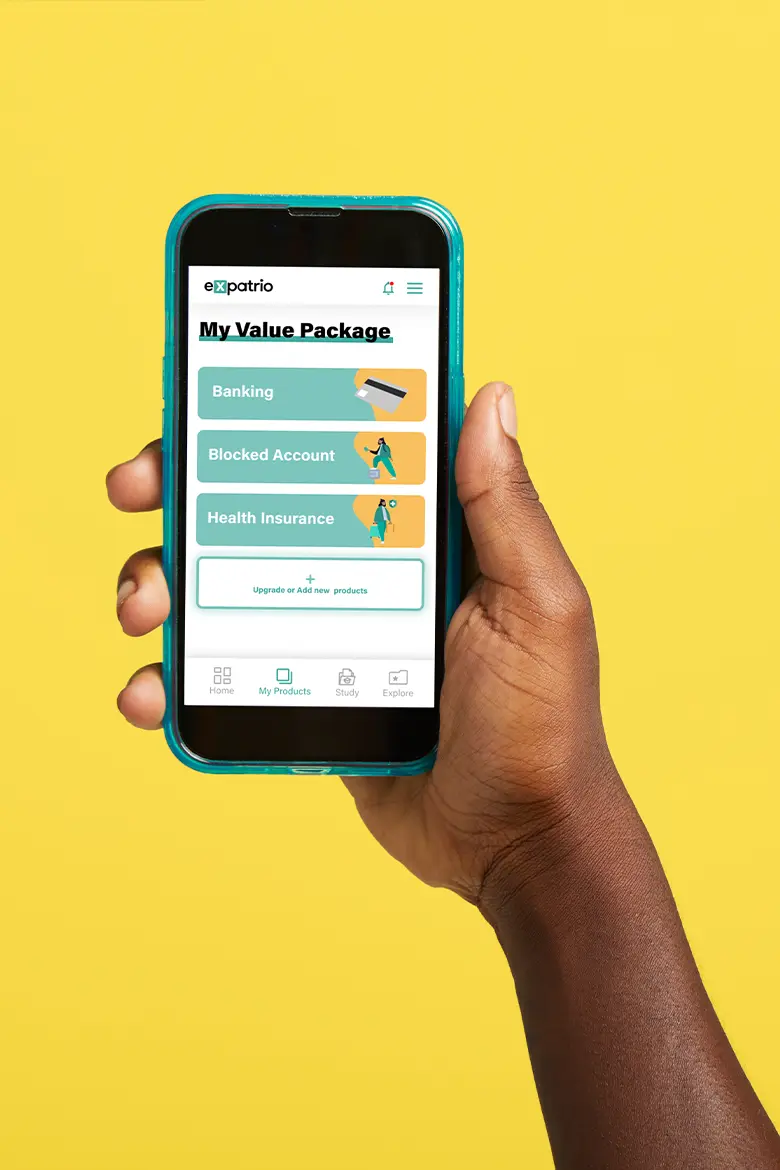

Expatrio Value Package

Simplify your move to Germany with Expatrio's Value Package! Get your mandatory Health Insurance + Blocked Account + free German Bank Account, and other free benefits!

How to get your Blocked Account

Apply online

Fill in our online application form via our secure platform to open your Blocked Account.

Transfer funds

Instant confirmation

Once your funds are received, you will get an instant blocking confirmation. Download your Blocked Account confirmation for your visa appointment.

Activate your products

Activate your Blocked Account and free German Bank Account via the Expatrio User Portal in one simple process once you arrive in Germany. Your Blocked Account payouts will be automatically deposited to your free German Bank Account with Expatrio every month. No other Bank Account or IBAN is needed!

"With Expatrio, I was able to open a Blocked Account in just a few simple steps. With my Blocked Account in place, I was able to obtain my student visa and make my move."

Parag Nirwan

Master's Degree in Applied Computer Science

Blocked Account

Simple account opening in just a few minutes

-

Fast: official Opening Confirmation within 24h

-

Affordable: set-up fee €69 + €5 monthly

-

Compliant: accepted by German authorities worldwide

-

New: includes our free German Bank Account for instant Blocked Account payouts. Automatically connected to your Blocked Account.

-

Fast Customer Service: 24-hour response time

-

Money-back guarantee: in case of visa rejection

-

High security standards

How Our Customers Feel About Our Service

What's the cost to open a Blocked Account with Expatrio?

The current blocked amount set by the German government is €992 per month, for every month of your planned stay in Germany.

Don't worry, for stays more than one year, just set-up a one-year Blocked Account and then you can extend your account as needed.

The money in this account is still your money, however it is used as proof for the German government that you have enough funds to live in Germany,

Our 12-month Blocked Account break down for you

Blocked amount required by the German authorities

€11,904

€992*12 months

Initial set-up fee

€69

Monthly fee

€5

Total for 12 months is €60 (€5*12)Buffer

€100

Returned in full with your last Blocked Account payout (unless some funds were used to cover transfer fees).

Total

€12,133

Tip!

Get our Value Package and receive cashback and many other benefits, like free Travel Health Insurance.

How to open your Blocked Account

Legal background of the Blocked Account

Our Blocked Account fully complies with the applicable immigration law.

The Blocked Account is complying with the highest instances and complies with all German authorities’ laws, provisions, treaties, and requirements regarding visa applications and residence permits. Including but is not limited to § 2 (3) Residence Act (AufenthG) and 16.0.8.1 Administrative Order of the Residence Act (VwV-AufenthG). The monthly Blocked Amount is regularly €992 (€11,904 per year), which is specified in the §§ 13 and 13a (1) Federal Training Assistance Act (Bundesausbildungsförderungsgesetzes - BAföG) for students at secondary schools and universities in Germany.

FAQs

What is a Blocked Account?

A Blocked Account is a bank account required by the German Authorities as proof of sufficient financial means necessary to receive a German visa. A Blocked Account is essential for international students, language students, au-pairs, job seekers and many people who want to move to Germany. The monthly amount that should be 'blocked' is changed regularly and adjusted to Germany's minimal cost of living. In 2024, the required blocked amount is €992 per month or €11,904 for the whole year.

New: What is the required blocked amount for 2024?

This increase is decided by the German authorities, and is based on the new Bafög rate for 2024. You can read all about it here in our helpful article.

You can transfer more than this amount if necessary. For example, if your Blocked Account needs to cover 18 months, you should transfer the required amount for each of the 18 months. For a student, this would be 18 x €992, totaling €17,856. For more information, visit our Help Center here.

Why should I open a Blocked Account?

If you are going to Germany for the long term and need a visa, it is highly likely that you will be asked for a confirmation of your financial resources. To do this, you need to open a Blocked Account and bring the confirmation to the German Authorities in order to apply for the visa.

Expatrio can provide you with instant blocked amount confirmation, once the funds are transferred into your account. This confirmation is accepted by all German authorities worldwide.

Is the Blocked Account by Expatrio accepted to get a German visa?

Yes, the Blocked Account Expatrio provides is accepted by all German authorities worldwide.

What is the difference between a Blocked Account and a Bank Account?

A Blocked Account and a Bank Account are two different types of accounts. You need a Blocked Account to get your German visa, and a Bank Account to manage your money once you're in Germany.

Blocked Account:

A Blocked Account (Sperrkonto) is required to show the German authorities that you have enough money to live in Germany. The money in this account is 'blocked,' meaning you cannot use it until you arrive in Germany. Once you're in Germany, you need a Bank Account to access this money.

Bank Account:

A Bank Account, also called a ‘current account (Girokonto),’ is used for your daily expenses in Germany. You can use it to pay for rent, groceries, health insurance, and more. You’ll get a free digital debit card, and you can also choose to get a physical card if you would like.

When you get to Germany, your monthly payouts will be sent automatically from your Blocked Account to your Bank Account, arriving instantly.

With Expatrio, you get this German Bank Account for free with your Blocked Account, so you don't need another German Bank Account.

How can I open a Blocked Account?

You can open a Blocked Account with Expatrio in just a few minutes, 100% online.

To do so; go to our webpage, choose Blocked Account, and then go through the questionnaire.

After that, you will be asked to provide some personal information to create a user account. When the account is created and approved, you will be able to access the bank details necessary for the money transfer. When the funds reach your bank account, you will get the confirmation document necessary for your visa application.

How much does it cost to get a Blocked Account?

The Blocked Account fees paid for Expatrio services are €69 for account setup (one-time fee) and €5 monthly fee. Please take into consideration that together with these fees, you will be asked to transfer the blocked amount required by the German Authorities. This amount varies depending on the length of your expected stay in Germany. An additional €100 buffer is required as it will be used to cover potential transaction fees if such occur. The buffer will be sent back to you together with the last monthly disbursement from your Blocked Account.

How can I transfer money to my Blocked Account?

You can use any bank or remittance service to transfer the necessary amount to your Blocked Account. Via Expatrio Payment, you can perform a domestic transfer in your own currency in many countries, making the process faster and less expensive. You also have the possibility of transferring in USD or EUR.

How long does it take for my money to arrive in the Blocked Account?

Normally international money transfers take around 3-5 business days, while domestic bank transfers take 2-3 business days. However, in some cases, the process can last up to 14 days. The speed mainly depends on the country from which the money is transferred and the channel which is used for the transaction. When choosing the domestic transfer option (if available), the money transfer usually takes 1-3 business days.

How do I know that the funds have arrived in my Blocked Account?

You will immediately receive an automatic email confirmation when the funds arrive in your Blocked Account. This confirmation can be brought to your visa appointment as proof of your financial resources.

How long does it take to get the first payment from my Blocked Account?

From the point in time when you request to activate your Blocked Account by submitting all the necessary documents, it will take us 24 hours to validate them. After the documents are validated, it can take 2-3 business days for the transaction to take place and the money to arrive.

With our new German Bank Account, you will receive your monthly Blocked Account payouts instantly.

What happens if my visa is rejected?

In case of visa rejection, Expatrio will transfer you back the whole amount from your Blocked Account as well as the service fees.

What documents do I need to activate my Blocked Account and Bank Account?

You will need your:

- passport

- proof of address

- proof of residency

For detailed examples, as well as information about exemptions please visit our dedicated Help Article.

Do I need to provide an IBAN or other bank details to access my Blocked Account payouts?

No, with Expatrio you get your Blocked Account and German Bank Account all on one app. You do not need to enter any additional banking details.

Your monthly Blocked Account payouts will be automatically sent to your Bank Account, both accounts are included with Expatrio.

Free Downloads!

We are here to make everything easier for you.

Find ebooks, reports, checklists, and many more resources to help you with your life in Germany.

Footnotes

[*] Up to €269 savings consists of: €69 cashback on Blocked Account set-up fees + up to €90 TK-Flex cashback + free travel health insurance worth up to €95 + free digital ISIC card worth up to €15. This offer is only valid for customers who apply for the Value Package. Expatrio reserves the right to cancel this promotion at any point in time. Special terms and conditions apply.

[1] Value Package customers can receive their €69 cashback after activating both their Blocked Account and Health Insurance.

[2] TK-Flex is an elective tariff and only available for eligible TK health insurance customers. Once the TK membership is activated, TK-Flex can commence. Expatrio will provide the customer with detailed guidelines on how to do this. Within TK-Flex, users have the option to deselect/opt out of services they do not need. In return, there is a cashback bonus of up to €90 per year. However, if the services are needed after all, TK customers can reactivate their health insurance coverage by paying a deductible of €24 per service (up to €120) per year. Please refer to our TK-Flex page for more information.

[3] Free Incoming/ Travel Health Insurance coverage for up to 92 days as part of the Value Package for eligible customers worth up to € 95.00.

[4] Focus Money has awarded TK the 'Best Student Health Insurance Fund,' Study Travel Magazine has awarded DR-Walter the 'Super Star Award'', and Kubus has awarded ottonova first place in the service and customer satisfaction categories three times in a row.

[5] Upon opening your Bank Account, a valid visa or a valid residence permit will be required in order to maintain access. The timeframe in which you will need to provide these documents will be provided to you.